Mortgage Broker in Victoria, BC

Fast, Friendly and Local Mortgage Expert

Hi, my name is Jennifer, a mortgage broker in Victoria, BC. I can help you find the perfect mortgage with one of my 60+ lenders and set you up for financial success. If you’re ready to get started or just need advice on what to do next, I’m here to help. Click the button to contact me.

Professional Mortgage Advice

As a Victoria mortgage broker, I focus on clear guidance, quick responses, and financing that fits your life.

Friendly Service

Fast, Online Approval

Strong Communication

Local Expertise

Custom Mortgage Solutions in Victoria, BC

From first-time buyers to renewals, I match you with lenders as your mortgage specialist in Victoria, BC.

Testimonials

Kind words from my clients

The best part of my job is getting to interact with amazing people and solve interesting challenges. If you’re looking for a trusted Victoria BC mortgage brokers, here’s what local clients say.

60+ Lenders

Amazing rates from Canadian lenders

Access to 60+ lenders means better options for mortgages in Victoria, BC. I work with big banks like TD, Scotia and Manulife. Credit unions like Coast Capital, and mortgage-only lenders like MCAP and First National. This is just a handful of my dozens of lender partners.

About me

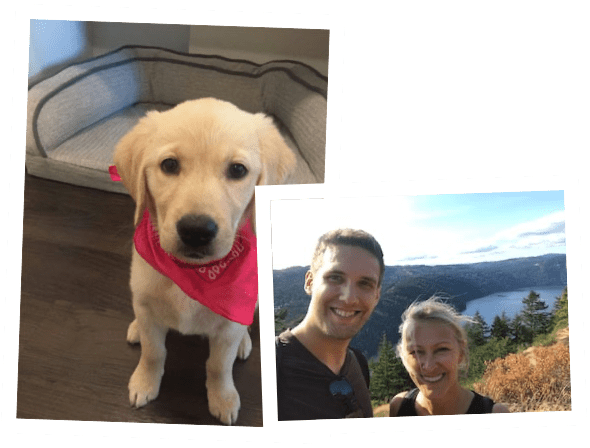

Hello, I’m Jennifer 👋

I’m a Victoria based mortgage broker helping clients feel confident about their financing.

Real estate is a financial vehicle to build wealth. And a mortgage is a powerful and often misunderstood tool in your financial journey.

My goal is to help put you in the strongest financial position of your life. That means working together with a common goal.

When you’re my client, I’m going to treat you like family and work like crazy to make sure you walk into your home everyday feeling good about how everything worked out.